Blog

For the Public Adjusters

Tornado Damage And What Is Covered By Insurance Policy

Policyholders who suffer property damage from tornadoes shouldn't fear if the words "Tornado Damage" does not appear in their homeowners' or businessowners' insurance policy. The word “tornado” does not exist in most insurance policies. However, what does exist is the...

Greensboro Tornado Insurance Claim Advice Help Assistance

Greensboro Tornado Insurance Claim - North Carolina: Shocking tornadoes trigger apparent physical and "visible" damage. Even so, most of these tornadoes result in considerable "hidden" problems as well. In both instances, policyholders could find themselves in a...

Storm Damage Claims Issues Hurricane Irma Victims Still Waiting On Insurance

Storm Damage Claim Help NC: Be it wind damage, hail, tornadoes, or hurricane damage to your home - insurance companies just don't want to pay what you are entitled to. We have been explaining this to policyholders for years. Here is two additional policyholder stories...

Can A Public Adjuster Obtain Higher Compensation For Property Damage Claim

Insurers In General Will Always Try To Outwit You And Low-Ball Your Damage Claim There is a perception that most insurers try to outwit and outsmart their clients during the damage claim process. At the time of settlement from serious property damage claims like fire,...

Fire Claim Policyholder Burned By Insurance Process

Insurance Companies Require Written Inventory From Fire Claim Victims' Burned Homes The insurance company may only payout 30% of your fire claim damage when you have a total loss fire? How can that be? See this story from ABC News: [arve...

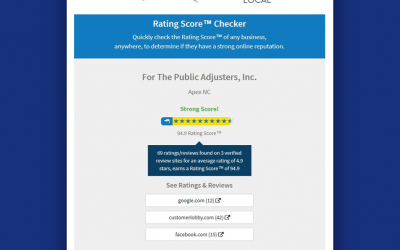

Top Rated Public Adjuster Reviews Receives 94.9% Rating Score For NC Claim Help

For The Public adjusters, Inc. of NC receives highest Public Adjuster Ratings for Public Adjuster Reviews from Top Rated Local. A search conducted through Top Rated Local's Score Checker shows For The Public adjusters, Inc. of NC has an overall average Review Rating...

Independent Public Adjuster Secures $330,100 Increase Over Fire Damage Claim

A historic home, insured for $674,000 was destroyed by a large fire. The owner of the house hired his daughter to act as his attorney. For more than a year, the attorney was kept waiting with little progress. After much frustration, the owner's daughter decided to...

Private Adjuster In NC Increases Business Claim Settlement By $136k

Private Adjuster, NC: A windstorm can bring about widespread damage. Unfortunately, one coastal hotel learned the hard way that their second issue would be dealing with their insurance company. The Best Western Hotel suffered extensive damage to the roof, from...

Benefits of Hiring a Public Insurance Adjuster

Property damage, large or small, has always been a stressful one for homeowners. In addition to the stress of the damage incurred, there is the trouble of with your insurance company adjuster, which can make the stress even more difficult. In most cases, especially...