Water Damage Insurance Claims Help For Policyholders In NC & VA

There are many ways a property can suffer water damage. Water can affect a home or building from a ruptured water heater, sewage backup, toilet, sink or tub overflows, leaky dishwasher, washing machines and hoses, frozen or ruptured pipes, and even wind driven rain from a storm event.

Whichever cause of the loss that may have occurred at your property, most water damage is covered by your policy.

Schedule a Consultation

Get your property claim damage questions answered for free. No sales pitch, No pressure. Just answers.

Water Claims are Complex

Insurance agents will do anything possible to save their company money, even if it means short-changing you.

Ready to get 747% back?

With a professional, public adjuster on your side, you can do phenomenally better on your claim.

Don't Miss Anything

We have reviewed thousands of claims. We make sure nothing get’s missed, and you get what you deserve.

A common mistake by policyholders is that they are under the impression that flood damage is considered water damage.

However, they are totally different claim types as water damage claims are covered by your policy and flood damage claims are excluded under property insurance policies. Never call your insurance company and claim that you have a flood when you do not. Always say you have water damage.

The absolute most important thing you are required to do as outlined in your policy is to protect your property from any further damages:

- We will pay the reasonable cost incurred by you for the necessary measures taken solely to protect covered property that is damaged by a Peril Insured Against from further damage.

Take Action to Prevent Moisture & Bacteria Growth

In a water damage situation, you must take action to prevent the spreading of moisture that will cause additional swelling of building materials and/or mold and bacteria growth.

Keep in mind, this is YOUR responsibility. YOU must protect from further damage. The insurance company will pay whatever it costs to do so, however, YOU need to arrange proper mitigation and drying of your property. The removal of water-damaged materials and the drying of the property must begin immediately.

However, be careful whom you choose. Personally, we do not recommend using a drying company referred by your insurance company. Those companies have a history of showing loyalty to the insurance company’s checkbook and not really looking out for you. Feel free to call 919-400-6440 for an unbiased referral.

It’s important to know that you as the policyholder, do not have to use the Contractors suggested or referred by your Insurance company. It’s your property, your claim, your money, and your choice!

In addition, how you go about handling the water damage to your property within the first 24 hours will be critical to the outcome of your claim. For example, we often see field adjusters sent out by the insurance company that are not trained in water damage losses.

They neglect to apply simple water mitigation rules like removal of drywall, baseboards, tile floors, and other finishes. Such neglect prevents air to properly circulate behind wall cavities where mold and bacteria can grow. Wet carpet always needs to be pulled up or discarded.

Carpet pad needs to be removed as it heavily absorbs water and can harbor bacteria that will also turn to mold. Your adjuster is not trained in water damage mitigation.

In this photo: mold can grow and spread behind kitchen cabinets from a dishwasher leak. The adjuster insisted the water could not have gotten behind the cabinets. As you can see, the insurance company adjuster was uneducated on how water can wick and spread. There are life, health and safety issues that need to be addressed when cleaning and drying a Black Water situation.

It’s not hard to understand that most people do not understand the affects of water damage or even understand the insurance claim process itself.

Simply, because it’s something that you may only go through once in a lifetime. It’s for this reason you should have professionals assisting you with such damage. If improperly handled, water can cause significant and costly damages and/or sickness in your home or building. There are different types of water as well as different levels of damage to consider.

- Category 1: Fresh Water from a busted pipe, uncontaminated.

- Category 2: Dirty Water from a washing machine, dishwasher, slightly contaminated.

- Category 3: Black Water from dirty toilet, entry from outside of home, highly contaminated.

All water can become contaminated in as little as a few hours depending on the circumstances. Yes, even fresh, clean water can affect the health of your home and family if not addressed and treated properly.

Fresh water can become Black Water rather quickly. The process of handling each Category of water is completely different and requires special care and treatment. Black Water from sewage carries several toxins that are released in your home or business. When your insurance adjuster suggests that you merely need to dry this type of moisture, you’re putting people at risk without consulting a professional.

So, again, most people have had no prior experience in how to handle an insurance claim, their policy and its language can be very confusing and frustrating to deal with. To obtain fair and accurate compensation for your insurance claim, it is highly recommended to discus your situation with an experienced claim professional that can advise you of all your options. With such, you will be able to make informed, educated decisions on how to move forward and how to obtain the maximum payout you are entitled to for your loss.

Finally, the mere fact that water damage claims are the most frequent type of insurance claim submitted to carriers nationwide and are also the most costly to the insurance industry, we are noticing more and more insurance companies attempting to shift costs to the policyholder. They are generating cleaver ways to do so even knowing that their policies cover these losses. There is even a new tactic of inserting language in the policy that states any water loss reported after a period of 14 days will be excluded from coverage. Does this sound as if your insurance company is looking out for your best interests? If your water damage claim has coverage from days one through thirteen, how can the insurance company say that your water damage is NOT covered after that. This can be devastating to a policyholder. Get assistance! Do not attempt to battle this type of scrupulous activity on your own.

Water damage claim tips and help for homeowners and business owners that have property damage from water

Knowing what to do may not be as important as knowing What NOT To Do after a water damage insurance claim. Below is a list of Do’s and Don’ts when it comes to water damage claim situations.

As insurance claim professionals since 1998, we have reviewed thousands of claims and have found that both insurance adjusters, policyholders, and contractors have unknowingly and will often miss hidden damages caused by water. The fact is that in almost all instances, it is better to have a qualified and certified water damage representative review your claim. Our Public Adjusters are IICRC Certified in water damage restoration, have been insurance damage contractors, and are licensed insurance adjusters. We know both sides and are experts on both sides.

You should consider speaking with and using a qualified expert that will be looking out for your best interests. After all, it’s free to simply speak with someone to get a feel for where you stand.

What To Do Water Damage Insurance Claim Tips:

- Call a Public Adjuster for proper claims handling and advice.

- Take photographs showing damages before cleaning or removing anything.

- Mop or towel up as much excess water as possible.

- Wipe as much water as possible from wood furniture.

- Pin draperies up off the floor as soon as possible.

- Pin furniture and bed skirts up off the floor as soon as possible.

- Remove and/or prop-up any wet upholstery cushions for drying.

- Check furniture, drapes, carpets and rugs for bleeding colors and remove as necessary.

- Place clear wrap, aluminum foil, coasters or unfinished wood blocks under furniture legs

to keep from bleeding or rust transfer to wet carpet or floors. - Remove any throw-rugs from wet wall-to-wall carpeting.

- Open wet kitchen, bathroom, and furniture drawers and doors for complete drying.

However, do not force open which could cause more damage. - Remove any and all valuable items that can be affected by moisture to a safe location.

Such as, oil paintings, art objects, furs, silks, etc. - Soak up excessive water on carpets with clean white towels.

- Place wet boxes, suitcases, bins in sunlight if possible. Open for increased drying.

- Use a screwdriver to push small holes in any sagging ceilings to release trapped water.

Use a bucket or trash can to catch the excess water. - Protect yourself against contact with sewer and sewage contaminated items. Wear gloves, boots, goggles, protective clothing and respirator if you absolutely have to clean or handle contaminated items. Contact your doctor if you have any adverse health problems.

What NOT To Do Water Damage Insurance Claim Tips:

- Do NOT: Leave wet fabric on beds, in closets, drawers, etc. in place – hang-dry right away.

- Do NOT: Hang leather or fur coats to dry at room temperature.

- Do NOT: Leave any color items like magazines, books, newspapers on wet flooring or carpet.

- Do NOT: Use a household grade vacuum to remove water.

- Do NOT: Use a wet/dry vac as electric shock could occur.

- Do NOT: Eat any foods or touch cans that may be contaminated or exposed to sewage.

- Do NOT: Turn on fans or dehumidifiers that could spread contaminants throughout building.

- Do NOT: Use any electronics exposed to moisture or while you are standing on wet surfaces.

- Do NOT: Use any electrical items while standing on concrete floors.

- Do NOT: Turn on any ceiling fans under wet ceilings.

- Do NOT: Hang around rooms with sagging or collapsed ceilings from standing water.

- Do NOT: Turn on an HVAC system that has been directly contacted by water.

- Do NOT: Turn on an HVAC system that could spread airborne contaminants.

- Do NOT: Remain in a home or building exposed to a sewer backup situation.

- Do NOT: Remain in a wet home or building if you have respiratory problems.

- Do NOT: Remain in a wet home or building if you have allergies or asthma.

- Do NOT: Remain in a wet home or building if you live with anyone under the age of 2.

- Do NOT: Remain in a wet home or building if you live with anyone over age of 60

- Do NOT: Remain in a wet home or building if you have have a weakened immune system.

- Do NOT: Remain in a wet home or building if you have have an illness or taking medication.

Obtaining Help With Your Water Damage Insurance Claim

It can be disheartening when you pay insurance for years and you’re under the impression that you will be taken care of in your time of need, only to find out that the second catastrophe is dealing with your insurance company after you have incurred damages to your property. Your insurance adjuster has advised that they are paying you a specific amount for your water damage claim. Yet, your contractor’s estimate is significantly higher. It can be a rather frustrating battle.

This has become the biggest problem we hear from policyholders suffering from a water damage insurance claim. They feel that they have become caught in the middle of their insurance adjuster and contractor. They question becomes, “How do I know if my insurance company is trying to low-ball me, or if this contractor is trying to sell me more than I need?” It’s for this reason you should consider an unbiased claim damage inspection of your property. Not doing so can cost you thousand’s of dollars.

What Is The Most Costly Water Damage Mistake Made By Most Policyholders?

Every day really smart people who are professional accountants, doctors, lawyers, teachers, and considered socially intelligent, are willingly accepting insurance adjuster’s calculations for water damage claims. They blindly relinquish their full trust to an adjuster who works and has loyalty to their insurance provider. Time and time again this happens without obtaining any assistance or consulting with an insurance claim specialist.

This is and will forever be the most costly mistake people could ever make when dealing with their insurance claims. It’s bad enough that you have suffered the damages to your property, to then just surrender all common sense and rely on an adjuster who is not really there to take care of you, just doesn’t make sense. Does it? This one person visits your property, inspects your water related damage, they generate a totally BIASED AND UNCONTESTED valuation of the loss, and you should just figure that this adjuster has your best interest in mind…

Does This Make Any Real Sense?

Be Aware of Water Damage Insurance Claim Scams

You Know Your Property Best

Your insurance adjuster doesn’t really know everything about your home or building. If you have suffered water intrusion, the adjuster doesn’t really know everything about your contents (furniture, clothing, etc.) like you do. How can an insurance company adjuster possibly be as accurate about your property and belongings than you? In addition, just because the insurance company sends an adjuster to visit and inspect your property, does not automatically make them an expert builder, contractor, or even certified in water damage restoration.

Water Damage Insurance Claims We Have Assisted Policyholders with:

Saul’s Water Damage Claim, Zebulon, NC

The above photos are from a water damage claim suffered by the Saul’s family in Zebulon, NC. The Sauls had a toilet with fecal matter and urine overflow in a second-floor bathroom. A classic Category 3 Black Water situation. Mr. Sauls contacted us from our website after his insurance adjuster submitted a very low estimate of $4,400 for his damage. After we visited the property we advised Mr. Sauls that his claim would be in excess of $40,000. It turns out that the adjuster sent out by NC Farm Bureau had very little knowledge of water damage insurance claim and their issues. Like most insurance company adjusters, they only estimate what they can see. However, water infiltrates behind walls, under floors, and behind building finishes. After meeting with the NC Farm Bureau adjuster at the Sauls home and explaining the IICRC standards for water damage he followed our valuation and suggestions. At the end and after several discussions with the adjuster and his manager, we were able to recover $54,203.81 in covered water damage proceeds. As a result of our involvement, the Sauls’ family can now complete all the repairs needed to put their house back together the right way with no fear of any remaining contaminants left behind.

AN INCREASE OF

%

Water Damage Insurance Claims We Have Assisted Policyholders with:

Water Damage Claim, Raleigh, NC

These 3 photos are from a rental home located in Raleigh, NC area. This rental home suffered water damage to the floors, walls, moldings, cabinets, insulation, crawlspace and HVAC system from a ruptured frozen pipe. NCJUA Insurance sent an adjuster to inspect the damages to the home and provided a repair estimate in the amount of $6,347.63. The owner of the rental home called us after reading our Free Water Damage Claim Report to see if he was getting the correct coverage from his adjuster. As usual, after we inspected and valued the loss we requested that the NCJUA adjuster accompany us on a joint inspection. We were able to show water inside the walls and under vinyl floors using moisture reading equipment. Our proof showed the house needed to be gutted on the lower floor. After several back-n-forth negotiations the NCJUA adjuster agreed to our valuation of $89,124.90. This secured an additional $82,777.27 from the water damages missed by the adjuster. As a result of our involvement the final claim total went from $9,487.51 to $47,190.45. An increase of $37,702.34 over Safco’s original assessment.

AN INCREASE OF

%

Get Your FREE Water Report

The insurance company’s adjuster works directly for the insurance company. The water damage Public Adjuster works directly for you!

You already made the correct choice by paying for a policy to protect your property, now it’s up to you to protect yourself.

Be sure you are properly compensated for the coverage and policy you paid for. Together, let’s review your fire damage claim file for free.

No sales pitch, no pressure, we just answer all your questions and advise you on where you stand both in damage and in coverage.

Educate yourself by finding out the “mathematics” of your water damage insurance claim. Knowing where you stand will allow you to make an informed, educated decision on what to do next to protect yourself.

Water Damage Insurance Claim Tips:

Your insurance adjuster should explain all coverage that is available to you under your policy for wind damage. However, this type of detailed explanation is rarely disclosed or offered to you.

Often, this lack of disclosure is conducted on purpose, and on other occasions it’s also done on purpose (Did you read that? Forgetting to advise you of certain coverage’s is usually withheld until you ask. More often than not; it’s done on purpose.)

This is YOUR home or building, it’s YOUR belongings, it’s YOUR money, and it is YOUR coverage because you paid for it. You must educate yourself to ensure you’re being fully compensated for the wind damages YOU have suffered. With all this being said, you should consider hiring a claim professional. The insurance company has “THEIR” hired adjuster… Shouldn’t “YOU” have your own hired adjuster?

A Public Insurance Adjuster is someone who can look out for “YOU” and look over the shoulder of your insurance company, their estimates, their inventory lists, the amounts they have allotted and “YOUR” amount of loss.

You need to know by obtaining the assistance needed to obtain the “real-world” costs and valuations required to repair or replace the wind damage suffered to your property.

Deposit Your Claim Checks. It is Your Money...

This is not true and far from reality.

By law, the insurance company has to issue payment for what “they believe” they owe on the loss within the states allotted time frame.

By depositing the amount “they believe” they owe is not an agreement by you that you agreed that is all you are owed on your loss.

You can add missed damages

Underpaid funds can be reassessed after a closed claim

You can be fully compensated!

Water Insurance CLaims Resources

Can A Public Adjuster Obtain Higher Compensation For Property Damage Claim

Insurers In General Will Always Try To Outwit You And Low-Ball Your Damage Claim There is a perception that most insurers try to outwit and outsmart their clients during the damage claim process. At the time of settlement from serious property damage claims like fire,...

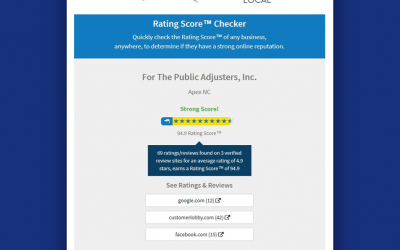

Top Rated Public Adjuster Reviews Receives 94.9% Rating Score For NC Claim Help

For The Public adjusters, Inc. of NC receives highest Public Adjuster Ratings for Public Adjuster Reviews from Top Rated Local. A search conducted through Top Rated Local's Score Checker shows For The Public adjusters, Inc. of NC has an overall average Review Rating...

Private Adjuster In NC Increases Business Claim Settlement By $136k

Private Adjuster, NC: A windstorm can bring about widespread damage. Unfortunately, one coastal hotel learned the hard way that their second issue would be dealing with their insurance company. The Best Western Hotel suffered extensive damage to the roof, from...